PRN Update – 1st March 2025 – Q2 Prices

Wayne Grant, Procurement Leader

Welcome to our latest PRN update of 2025. As we navigate the evolving landscape of PRN markets, it is important to note that verified quarterly recycling data will not be released until Defra publishes the figures at their discretion, typically in early March. This means that stakeholders will not have a definitive understanding of the final compliance picture for 2024 until then. However, unverified releases of the final monthly data for 2024 and the first month of the 2025 compliance year are now available. These releases provide valuable insight into whether the UK met its compliance obligations last year and how early 2025 PRN supply is shaping up – influencing early market trends and pricing.

The first release of quarterly recycling data for 2025 compliance will be available in mid-April, while the initial release of the UK obligation, which defines PRN market demand, is expected to land in May. With the transition from Producer Responsibility to Extended Producer Responsibility (EPR), understanding these figures will be more crucial than ever in determining what the PRN market needs to achieve before year-end.

We will discuss the currently available recycling data, estimations, projections, and their implications for the PRN market and pricing in our upcoming PRN market update webinar on 13th March 2025. You can register for your free place HERE. If you are reading this after the event, you can access the recording and slides via the ‘PRN Centre’ on your member portal.

Final Monthly Recycling Data 2024

Table 1: Total unverified monthly packaging recycling totals against 2024 final obligation.

The reported monthly data, as outlined in Table 1, shows that all the targets for materials in the 2024 compliance are looking likely to have been achieved.

The unverified monthly data in Table 1 suggests that all material targets for 2024 compliance are on track to be met. Compared to previous years, the UK has demonstrated improved recycling performance, particularly in contrast to the recent challenges of 2022. This progress has led to a likely increase in December PRNs available to carry over into 2025, contributing to early market stability and improved starting price levels compared to the same period last year. Official confirmation of compliance and carry-in figures will be released by Defra in March 2025.

January Monthly Recycling Data 2025

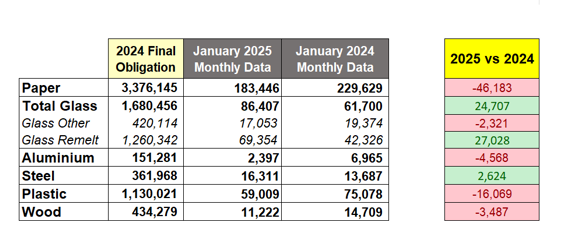

Table 2: Unverified Monthly Recycling Data for January 2025 and January 2024.

The strong finish to 2024 and the anticipated increase in PRN carry-in availability have positively influenced early 2025 pricing. However, stakeholders are now focused on building a comprehensive supply picture for 2025 PRNs. The January 2025 report (Table 2) shows mixed performance compared to the same period last year. Paper, Plastic, Wood, and Aluminium are currently behind their January 2024 levels, whereas Glass and Steel appear slightly ahead. It is important to note that these figures are unverified and subject to change.

Potential Future Markets and Impacts

Early unverified data from January 2025 suggests mixed recycling performance across various materials. Paper, Plastic, Wood, and Aluminium are currently trailing behind their January 2024 recycling rates, while Glass and Steel show slight improvements. These disparities indicate that certain materials may experience tighter markets, potentially leading to increased price volatility in their respective PRN materials.

The supply and demand dynamics of PRNs are key to understanding these fluctuations. One contributing factor to lower early-year recycling rates could be the perception of an improved carry-over position from 2024, which may have reduced the incentive to generate PRNs in the short term. Additionally, with the UK obligation yet to be confirmed, reprocessors/exporters are operating without a clear understanding of 2025 requirements, and the progress against one material’s obligation is usually the key contributor to price.

The broader economic environment also plays a crucial role in shaping the PRN market. As material costs fluctuate, consumer purchasing patterns shift accordingly, directly influencing the volume and composition of packaging waste entering the recycling stream. Under EPR, brand owners will bear full responsibility for compliance costs, meaning they will need to take a more proactive role in managing obligations and addressing potential price fluctuations. Moreover, as regulatory reviews continue, businesses are expected to adjust their waste management strategies and plan for future disposal fees in alignment with RAM (Recyclability Assessment Methodology) guidelines.

Given the interplay of regulatory changes, material-specific challenges, and economic factors, PRN prices are expected to fluctuate throughout 2025. Producers should prepare for potential increases in compliance costs, particularly in materials facing tighter recycling markets.

Q2 2025 PRN Prices

In setting the Q2 rates for 2025, we are considering various factors such as current recycling performances, our 2025 purchase rates to date, potential 2024 carry-in levels, current and forward market rates, seasonal trends, and average annual rates required to achieve set targets from previous years. This is considered alongside our industry knowledge and the experience we have gained through our strong relationships and regular communication with key suppliers and stakeholders.

Please see below in Table 3, our confirmed optimum variable rates (OVRs) for Q2, as well as some current estimated annual average figures. The estimates are presented as potential ‘low’ and ‘high’ figures to allow for thorough and considered budgeting.

Table 3: Q1 and Q2 confirmed Beyondly PRN pricing, average to date and estimated annual averages.

Summary

While 2025 still has many developments ahead, early indications are promising, with PRN prices showing improvement compared to this time last year. However, market uncertainty remains due to regulatory shifts, economic pressures, and material-specific challenges.

Our year-to-date PRN averages provide members with a stable foundation heading into the half-year mark. We remain committed to leveraging our purchasing performance, market insights, and strategic supplier relationships to ensure continued value and compliance stability.

A reminder that submission windows are now open for EPR. It is crucial to ensure timely data submissions for both PRNs and EPR reporting, enabling us to support your compliance effectively and maximise value.

We appreciate your continued support, patience, and engagement and look forward to delivering your compliance solutions throughout 2025.